This blog will help you to file own IT Returns online with ITR-1 form for Assessment Year 2021-22 (Financial Year 2020-21) with new IT Returns site 2.0.

Last Date: 31 December 2021. Advised to file income tax by October to get ITR processed quickly.

ITR-1 form is applicable if you have income from following sources:

- Salary

- One House property rent / loan

- Other Sources (Interest on saving bank account / FD etc)

- Agriculture income less than Rs 5000

- Total Income less than 50 Lac

Prerequisites for e-filing, (Keep below documents ready before you file returns)

- Form 16 from employer

- Form 26AS

- Interest from saving bank account / FD

- Dividend Income

- Tax free income like interest from PPF

- All bank account numbers

- Any investment that is not declared with company or not reflected in Form 16

Follow below steps to e-file your IT Returns (click on pictures to enlarge)

Step 1- Login to new site https://www.incometax.gov.in/

User ID is your PAN

On Dashboard, verify and update contact details and bank details

Secure account is optional

View and Download Form26AS

Step 2- Start New Filing from Dashboard

follow images sequence, all are self explanatory

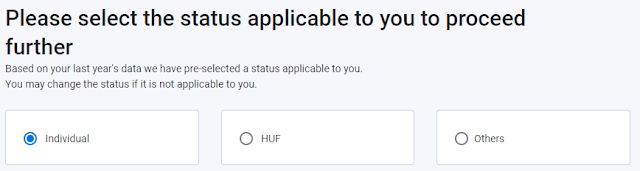

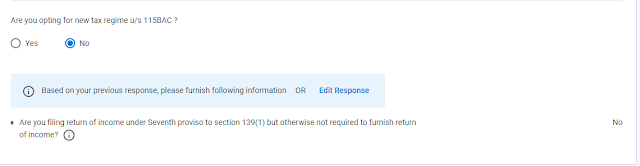

Step 3- Fill Personal Information

Select Tax Regime Old or New

Select any Validated bank account for refund

Confirm Personal Information

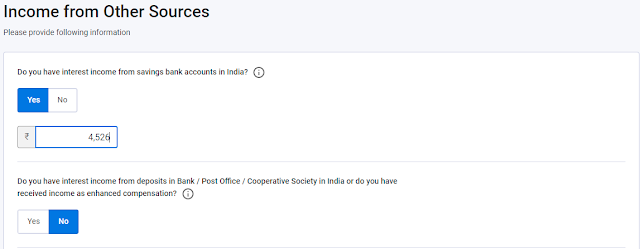

Step 4- Fill Gross Total Income

Refer Form 16 to answer below questions

Enter Interest component of home loan from Form 16 (max limit 2 lac for self occupied)

Enter interest from bank saving account and FD

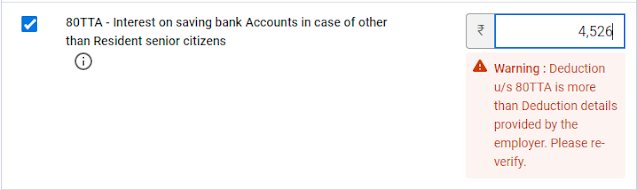

Step 5- Fill Total Deductions

80C Deduction

Claim for Self and family

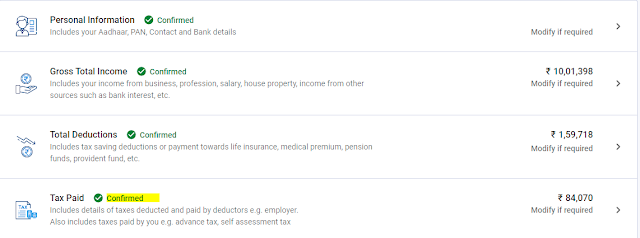

Step 6- Verify Tax Paid from From 26AS

Confirm Tax Paid

Step 7- Verify Total Tax Liability

Make sure total tax payable is 0 before submit, if tax is payable, then recheck all sections again. Still if tax payable exists, then make additional tax payment online from same portal to make tax payable 0.

Step 8- Preview and Validate Returns

Select Self and verify PAN

Check for validation errors

Step 9- eVerify and Submit Returns

Select Aadhar OTP if your mobile is linked to Aadhar, else use Net Banking option

Enter OTP and Submit Returns

Congrats !! You are DONE. No need to send ITR signed copy.

Step 10- Track return processing status on Dashbaord

Hope this post makes e-Filing 2.0 easy. Please share this blog link to your contacts and post your comments to improve this blog. You can also reach me at mihir.sdoshi@gmail.com.

Thanks

Mihir

Nicely explained ...

ReplyDeleteGood one sir..

ReplyDeleteIndeed Very helpful !! Keep sharing the knowledge..

ReplyDeleteGreat way to share step wise, thanks

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete