This blog will help you to file own IT returns online with ITR-1 form for Assessment Year 2020-21 (Financial Year 2019-20).

Last Date: 30 November 2020. Advised to file income tax by September to get ITR processed quickly.

ITR-1 form is applicable if you have income from following sources:

- Salary

- One House property rent / loan

- Other Sources (Interest on saving bank account / FD etc)

- Agriculture income less than Rs 5000

- Income less than 50 Lac

Prerequisites for e-filing

- Form 16

- Form 26AS (refer Step 4 below)

- Interest from saving bank account / FD

- Any investment that is not declared with company or not reflected in Form 16

Follow below steps to e-file your IT Returns (click on pictures to enlarge)

Step 1 – Get Form 16 from your employer

Step 2 – Register yourself at site https://www.incometaxindiaefiling.gov.in/home

Step 3 – Login on site

User ID is your PAN

Step 4 – Download From 26AS

Follow link My Account --> View Form 26AS (Tax Credit), you will be redirected to TRACES site. Download form 26AS for current Assessment year.

Follow link My Account --> View Form 26AS (Tax Credit), you will be redirected to TRACES site. Download form 26AS for current Assessment year.

Step 5 – e-File ITR-1

Follow link e-File --> Income Tax Return.

Select current Assessment Year and ITR form as ITR-1 and Submission mode as Prepare and Submit Online.

Follow link e-File --> Income Tax Return.

Select current Assessment Year and ITR form as ITR-1 and Submission mode as Prepare and Submit Online.

Select active back accounts from last year submission.

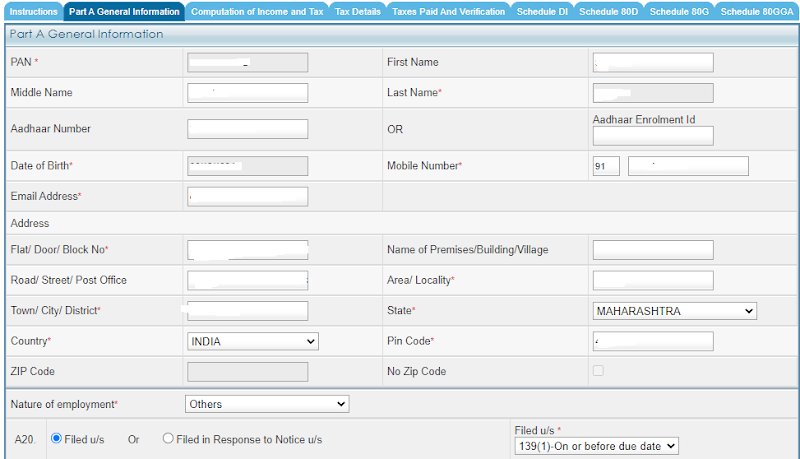

Step 6 – Fill Part A General Information

Personal information will be pre-filled. Validate and modify information.

Nature of employment: Others (for Private sector)

Filed u/s: 139(1)-On or before due date (if you file before last date)

Personal information will be pre-filled. Validate and modify information.

Nature of employment: Others (for Private sector)

Filed u/s: 139(1)-On or before due date (if you file before last date)

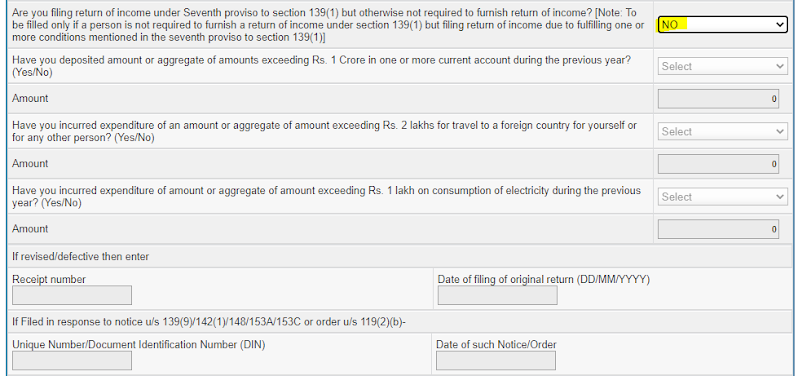

Are you filing return of income under seventh provision to section 139(1): No

Step 7 – Fill Schedule 80D

Take 80D details from Form 16,

Seperate medical premium amount for self / your family and your parents and enter. (look at your salary slip to get exact distribution of premium between self family and parents)

Step 8 – Computation of Income Tax

Add Salary/ Pension Details from Form 16

Professional tax: 2500

Add Salary/ Pension Details from Form 16

Professional tax: 2500

Interest payable on borrowed capital: Enter from Form 16. Applicable for home loan interest. (max limit 2,00,000 for 'Self Occupied' property)

Income from Other Sources: Not available on Form 16

Enter interest earned from all saving bank accounts + interest from all FDs

If you have invested after 1 April 2020 to 31 July 2020 select YES or select NO

80C: Investments - enter from Form 16 section 80C (max limit 1,50,000)

In case investments are not declared with employer, enter actual amount invested.

In case investments are not declared with employer, enter actual amount invested.

80D: Health Insurance Premium - This will be auto calculated from 80D Tab

80TTA: enter interest earned from all saving bank accounts (excluding interest on FD. Max limit 10,000)

80TTB: For senior citizons only - enter interest earned from all saving bank accounts (Max limit 50,000)

Exempt Income For reporting Purpose: Enter tax exempted income like Dividends form shares, PPF Interest etc.

Step 9 – Verify Tax Details

Details of Tax deducted at source from Salary will be auto populated. Tax deducted must match with Form 26AS. If not matching them enter details from Form 26AS.

Step 10 – Verify Taxes Paid

Make sure Amount Payable is 0.

You can have Refund in case extra tax is deducted by employer

Make sure Amount Payable is 0.

You can have Refund in case extra tax is deducted by employer

If everything is correct, pay remaining taxes by 'e-Pay Tax' action front of Amount Payable OR e-Pay Tax link on http://www.incometaxindiaefiling.gov.in/home. You will be redirected to NSDL website.

Select Challan No. 280 to make tax payment. After making payment BSR code and Challan number will be generated. Enter these details in Taxes Details tab Advance Tax and Self Assessment Tax section. Total Payable amount will become 0 now.

Step 11 – Verify all Bank account details

Select at least 1 account for refund

Step 12 – Verification and Preview

Make sure Total Tax Payable is 0 before you Submit.

Verify name / PAN Number. My Capacity as 'Self' for IT return.

Enter Place details

Select I would like to e-Verify option and Preview & Submit.

Make sure Total Tax Payable is 0 before you Submit.

Verify name / PAN Number. My Capacity as 'Self' for IT return.

Enter Place details

Select I would like to e-Verify option and Preview & Submit.

Step 13 – eVerify and Submit

Preview all details and Submit.

OTP will be sent on mobile linked to Aadhaar number. Enter OTP and Submit.

If you have selected EVC option. Enter EVC generated from Bank ATM or verify from online banking.

Preview all details and Submit.

OTP will be sent on mobile linked to Aadhaar number. Enter OTP and Submit.

If you have selected EVC option. Enter EVC generated from Bank ATM or verify from online banking.

Step 14 – Acknowledgement

You are Done! You will get Return successfully eVerified screen. No further action required.

You will get acknowledgement email with attachment.

Password: Enter your PAN (in small letters) and Date of Birth or Incorporation (in ddmmyyyy format)

Do NOT send this Acknowledgement to CPC Bengaluru.

Learn more on investing at Finology.

Thanks,

Mihir